27+ How much will mortgage lend

Compare Quotes Now from Top Lenders. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

Pin On Statement Template

Once you have a shortlist of mortgage lenders its time to apply with each of them.

. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. You may qualify for a loan amount of 252720 and your total monthly mortgage. As part of an.

Compare Best Lenders Apply Easily. Get Preapproved You May Save On Your Rate. To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and upwards.

The current average interest rate on a 51 ARM is 450. DTI Often Determines How Much a Lender Will Lend. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Compare Best Mortgage Lenders 2022. The first step in buying a house is determining your budget. Ad Find Mortgage Lenders Suitable for Your Budget.

Ad Todays Best Mortgage Lenders By Rates Service. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. 12 hours agoFill out the pre-approval application.

For this reason our calculator uses your. The Best Companies All In 1 Place. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

How Much Mortgage Can I Afford With A Joint Income Of 50k. Ad Compare Lowest Home Loan Lender Rates Today in 2022. This calculator computes how much you might qualify for but does not actually qualify you for a.

How do mortgage points work. Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. But ultimately its down to the individual lender to decide.

Fill in the entry fields and click on the View Report button to see a. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Ad Mortgage Rates Have Been on the Decline.

51 Adjustable-Rate Mortgage Rates. Apply Online Get Pre-Approved Today. Longer terms usually have higher rates but lower.

If you were to take on a 200000. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. How Much Interest Can You Save By Increasing Your Mortgage Payment.

For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time. A slightly lower multiple for two incomes than for one. Many lenders now only use income multiples as an.

With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below. Insurance and other costs. On a 30-year jumbo.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Common mortgage terms are 30-year or 15-year. Under this particular formula a person that is earning.

For instance a 400000 home loan could have a fee ranging from 2000 to 4000 fees. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. A mortgage loan term is the maximum length of time you have to repay the loan.

Want to Know How to Choose a Mortgage Lender. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. Heres what youll usually need to provide on the.

A preapproval doesnt guarantee approval for a mortgage but it helps with negotiations with. 1 day agoMortgage origination fees are generally 05 to 1 of the value of the loan. If you lock in.

Were not including additional liabilities in estimating the income. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. See all refinance rates.

The 52-week low was 409 compared to a 52-week high of 450. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. 2 days agoAt this point you will know the price range of the house you can afford to purchase.

Get Your Best Interest Rate for Your Mortgage Loan. One mortgage point will typically cost 1 of your loan amount and lower your interest rate by about 025. Compare Quotes See What You Could Save.

This mortgage calculator will show how much you can afford. Find out how much you could borrow. Then 45000 x 3 135000.

So 30000 15000 45000.

Average Cold Call Success Rate 2022 27 Cold Calling Statistics You Need To Know Zippia

27 Loan Agreement Formats Word Pdf Pages Free Premium Templates

Download Payment Agreement Template 20 Payment Agreement Agreement Credit Card Infographic

You Can See This New Request Letter Format For Degree Certificate At New Request Letter Format For Degree Certificate For Lettering Cover Letter Template Loan

Expense Budget Templates 15 Free Ms Xlsx Pdf Docs Budget Template Budgeting Templates

Now Showcase Your Logo Designs In A More Professional Way Using These Psd Premium Placemat Logo Mockup Templates Free Logo Mockup Logo Mockup Mockup Free Psd

Late Utility Payment Demand For Payment Ez Landlord Forms Letter Templates Being A Landlord Lettering

Mortgage Employment Verification Form How To Create A Mortgage Employment Verification Form Download This Mort Templates Employment Mortgage Loan Originator

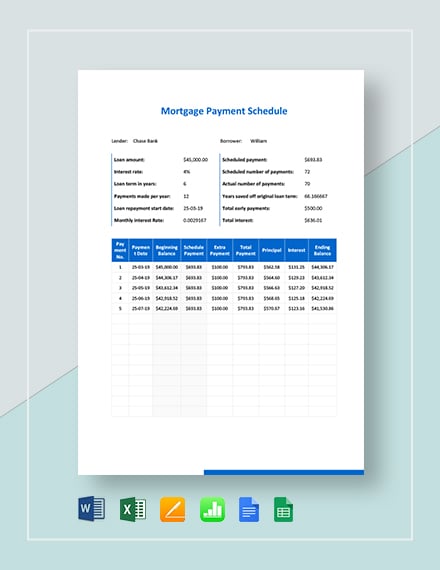

Mortgage Payment Schedule 5 Free Excel Pdf Documents Download Free Premium Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Casa Group Sale House Sunday Motivation Mortgage

Cover Letter Template Ymca Resume Summary Examples Academic Cv Cover Letter Template

Free Printable Promissory Note Promissory Note Notes Template Templates Printable Free

Supplemental Agreement Template Contract Template Contract Agreement Service Level Agreement

Hardship Letter Template 32 Free Word Document Payoff Letter Letter Templates

Free Promissory Note Form Printable Real Estate Forms Real Estate Forms Promissory Note Notes Template

Mortgage Pre Approval Letter How To Write A Mortgage Pre Approval Letter Download This Mortgage Pre Approval Letter Preapproved Mortgage Lettering Mortgage